About BayTradar

At BayTradar, we are at the forefront of utilizing cutting-edge AI technologies to drive investment strategies through algorithmic trading and statistical machine learning. Our journey began in 2020, and we proudly originated in the Bay Area, California. What sets us apart is our unwavering commitment to a value-added investment approach, which has been the cornerstone of our success in delivering industry-leading returns.

Expertise

At BayTradar, we are driven by our commitment to optimize investment strategies through algorithmic trading and statistical machine learning. Our team rigorously backtests and simulates each trading strategy before implementation, enabling us to swiftly adapt to ongoing market changes and accurately predict future patterns. Our system monitors a wide array of technical indicators and responds rapidly to correlative calculations. We take pride in the efficiency of our AI-driven research analysts who work 24/7 without the influence of human interference.

What We Do

Our AI autonomous trading bot system empowers us to deliver superior risk-adjusted returns.

Our Autonomous System -

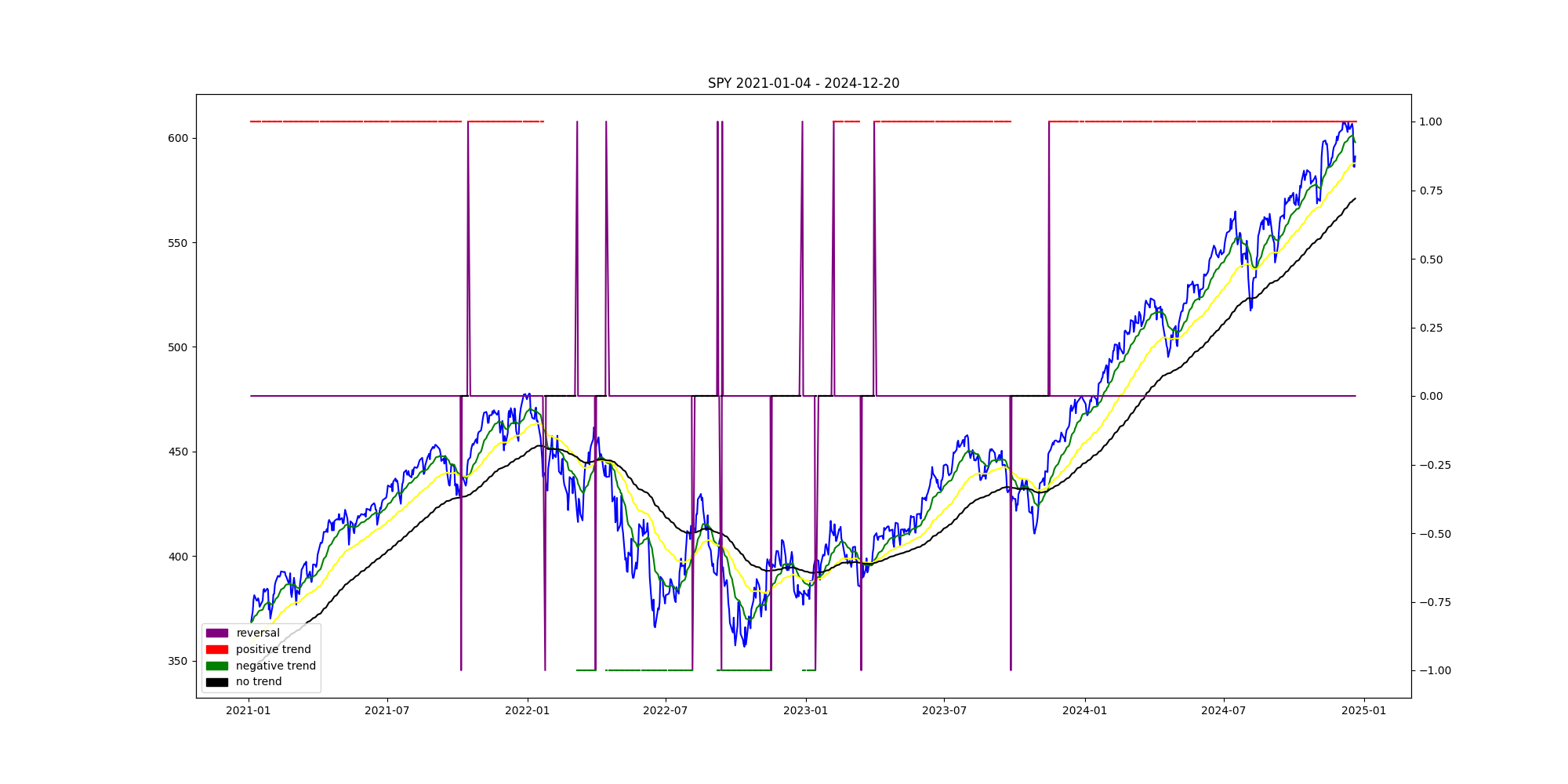

BayTradar AI Trading BotsOur strategies are driven by systematic approaches that prioritize diversification, volatility minimization, and performance enhancement. We are committed to effectively reducing downside risk by adhering to BayTradar's statistical method, ensuring stable returns for our clients. Our algorithm is designed to analyze various asset classes across different market scenarios. By discerning the level of bullishness or bearishness in each asset, we implement dynamic asset allocation, overweighting more attractive instruments and underweighting less favorable ones. This data-driven approach allows us to capitalize on the most promising opportunities and optimize our investment decisions for optimal outcomes.

Experiments

Contact Us

PO Box 9113 San Jose, CA 95157, U.S.A.

Email: contact@m.baytradar.com

Disclaimer

We don't provide any financial advice.